This Time Better Be Different

As 2s10s un-invert and the Fed gets ready to cut, financial markets enter untested waters.

I was going to lay off social media for the duration of my annual overseas golf orgy, but the markets seem to have different ideas. I won’t delve on the action in stocks because everyone can see that. The only important reference from a technical point of view is QQQ 0.00%↑ $476.26.

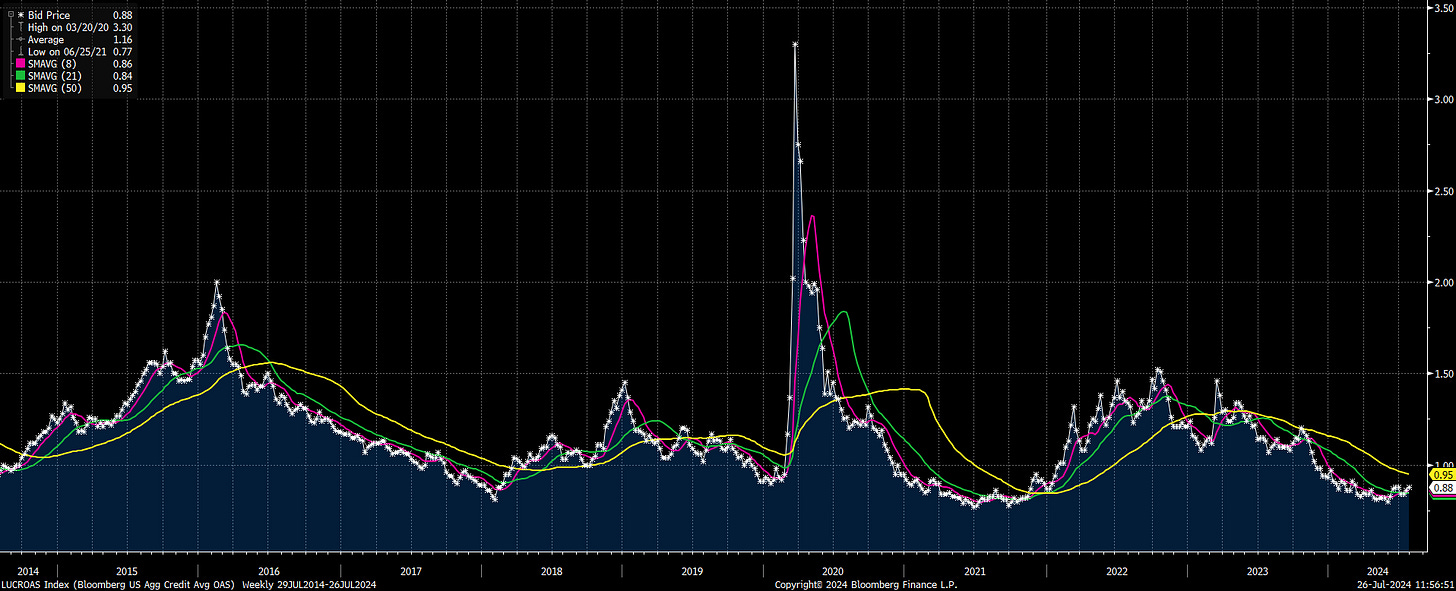

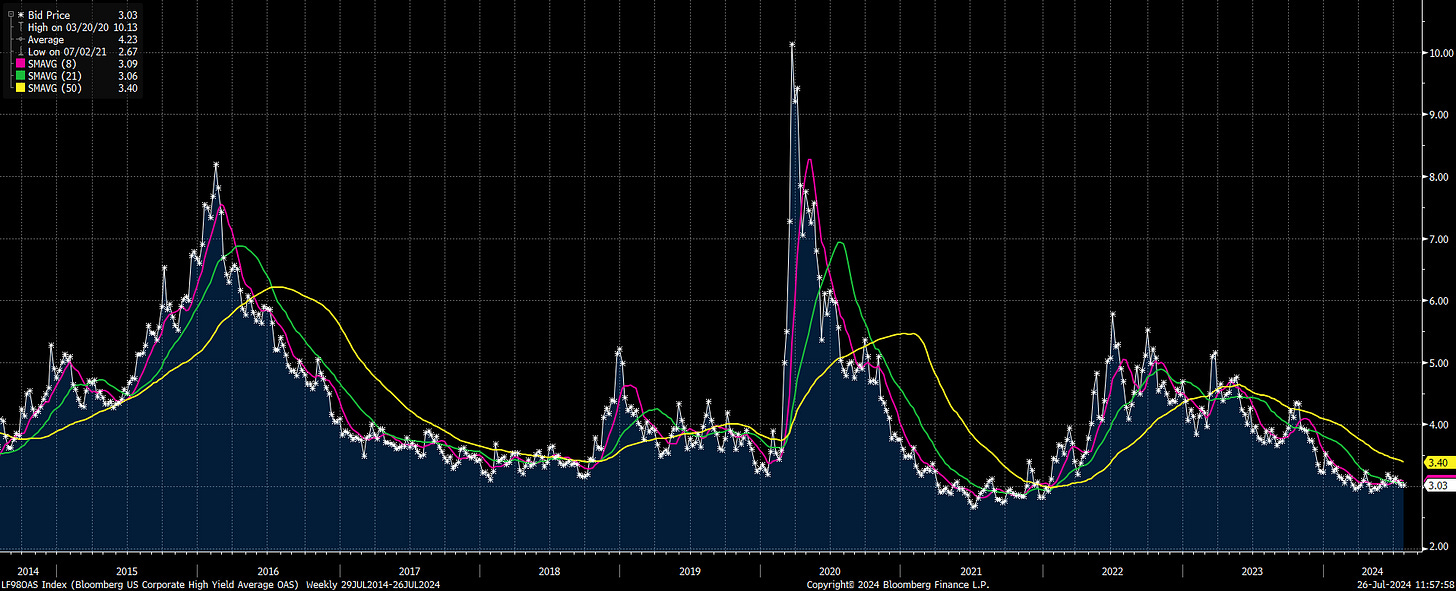

With respect to credit, so far risk spreads and the appetite for new corporate bonds issuance could not care less about the pullback in stocks. Investment Grade and High Yield spreads remain near decade tights (charts below)

and MTD / YTD issuance is relentless at $126b / $1,270b, on pace to shatter all annual records. And speaking of records, YTD newly announced buybacks of $715b are a mere $175b from breaking the all-time high, and there’s more than 5 months left to go.

Now for the scary bit: 2s10s at -19bps look to be on a mission to un-invert after the longest and deepest inversion ever. This is happening at the same time the Fed is getting ready to cut. This is NOT a good combo. For the gory details you can read this piece I wrote back in February, but the TL:DR version is in this excerpt, because the this current curve inversion has been different:

“The 2s10s inversion which began in June of 2022 is now the longest since the Sep. 1978 - Dec. 1981 stretch. Considering the inflation/rates chaos of those years, it is fair to say that the duration and depth of the current inversion is different. After the last two more recent inversions (‘99-’00 and ‘06-’07), credit crisis and market collapses followed shortly after the Federal Reserve cut rates reversing a sustained period of rate hikes (chart below). Keep that in mind, because all those who are bulled-up on a coming series of rate cuts are 100% betting that “this time is different”. I am not saying it can’t be, but it’s worth/necessary keeping one’s antennas up. If it is not different this time, corporate credit spreads should be our tell before a whole lot of stuff implodes.

So here we are: nothing in credit is heading in the wrong direction - yet - and if there ever was a time for equities to be past due a scary shakeout, it is now (insert any and all political, geopolitical, economic and social uncertainties). But redouble your focus on credit and let’s hope that “this time is different”.

Good luck!