In my most recent Substack articles and tweets I have highlighted that the confluence of a re-steepening of the 2s10s, the start of a Fed rate-cut cycle, the widening of credit spreads and the corollary drying-up of demand for corporate bonds, ushered in the last two credit crisis in ‘00-’02 and ‘07-’08.

With 2s10s about to re-steepen and the Fed ready to cut, the deciding factor comes down to the behavior of corporate credit. Today we did not get a definitive answer as to how things will play out this time, but a couple more days like today and the credit markets will have sounded the all-clear at least until the end of the year. Here is why:

The two / three weeks after Labor Day are THE SINGLE most important period of the year for corporate credit. It’s when companies rush to market with bond offerings, and bond buyers looking for assets to match their liabilities come shopping. If sellers pull back because buyers are skittish all sorts of bad things can happen, from routine bear markets like the one at the end of 2018, to full blown meltdowns if the credit markets stay frozen and leveraged credit funds are forced to sell.

Today the bond market put in a performance for the history books. I have been keeping daily tabs of corporate issuance since May 1, 2013, and today was the second biggest tally totalling $47.5 billion. Only Sep 11, 2013 was bigger at just over $50 billion.

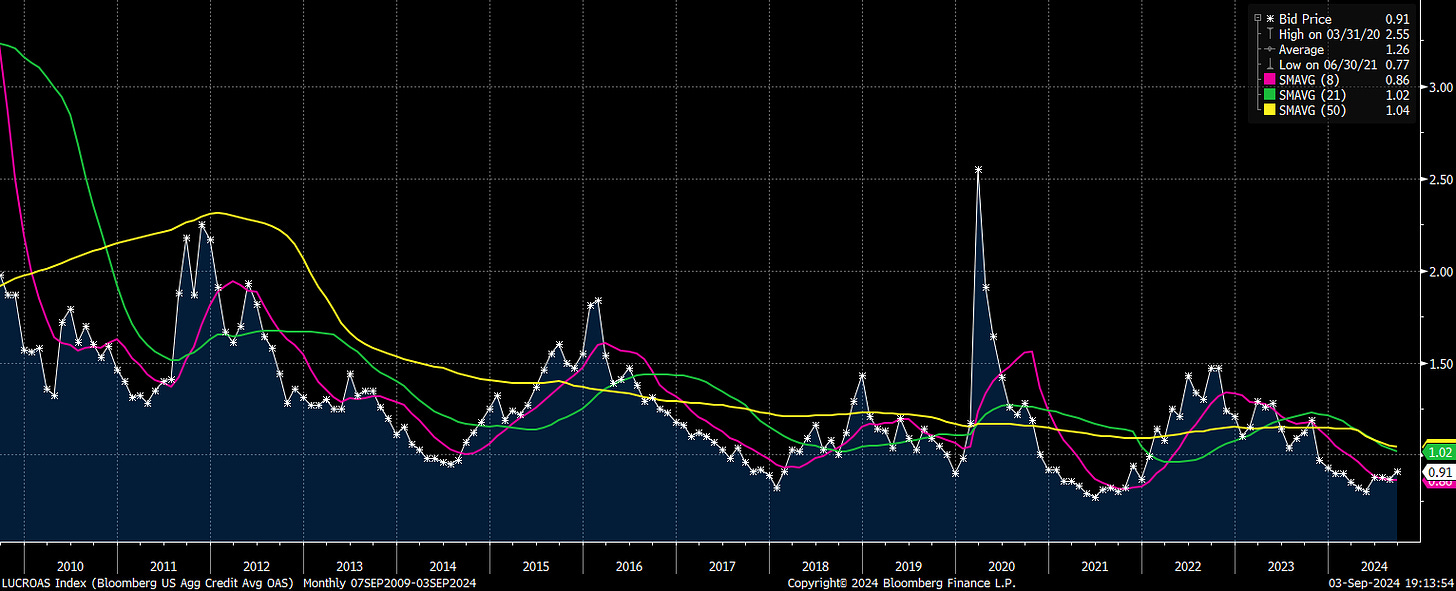

Perma bears may want to focus on Investment Grade and High Yield credit spreads, which widened 4bps and 11bps respectively, but that’s why they are perma bears. First, the widening is happening from near decade tight levels. Second, some widening on a such a gigantic issuance day is the least one should expect. Below are monthly 15-year charts of these risk spreads and as you can see today hardly registers.

If one wants to be extra careful, feel free to see how the rest of this week and the next play out, but today’s message from corporate credit was loud and clear: get out of its way.

So what to make of the shellacking in the stock market? Day-to-day, week-to-week, equities will do whatever they do. Machines, ETFs, 0dTE option players, story stocks, technical levels, etc. are the near term market movers, and most investors or traders are pawns in that game. But what has been true for the last 30+ years is that, as long as corporate credit is in good enough shape to fund buybacks, once the buyback desks decide that stocks have dropped enough and their their programs kick in, no one can stop them. As I pointed out on Twitter, new buyback announcements this year will top $1T, after $840B last year, and those bids usually hit the market 6-18 months after they are announced.

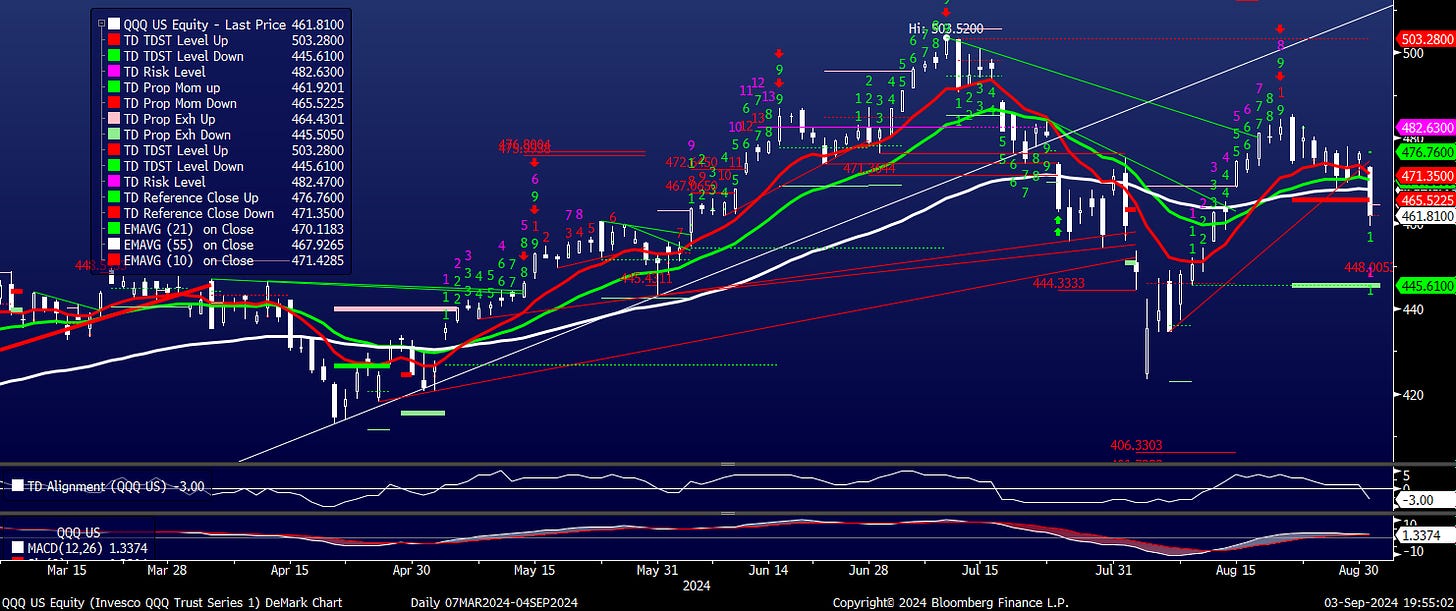

For the here and now, there are a number of technical signs that point to more weakness. Using the QQQ 0.00%↑ as a proxy, it’s trading below the 20 and 50 day moving averages, and today barely held the 100dma.

Also, as a devout follower of DeMark analysis, today the TD Propulsion indicator (by far one of the most reliable imho) triggered a downside target of $445.61. That also coincides with the daily TDST Level Down (at $445.51) which you can think of as the support level below which the daily trend flips negative. Not coincidentally, the 200dma is also in that general area, at $440.28.

So some patience and scaling (rather than jumping in with both feet) make sense, but for my money, as long as credit remains in good shape, more weakness remains an opportunity to get longer as I wait for buybacks to - once again - break the will of the bears.

Good luck!

Positions in QQQ and QQQ options.

Prescient.